Noel Lee’s AutoWealth is using robots to secure your financial freedom

Are you investing right now? We live in a world where people from all walks of life can invest and indeed do so to secure their future (and often, that of their loved ones too). Most of us aren’t too knowledgeable about investment options though, and that’s why we seek advisors to have long talks with.

But we also live in the digital world, and while advisors look at real-time data and graphs already, it’s only natural we’d ask more from technology. That’s why we are seeing the bloom of the Robo Advisor era, and AutoWealth is a startup leaning on tech to give you the safest investing advice based on your specific needs.

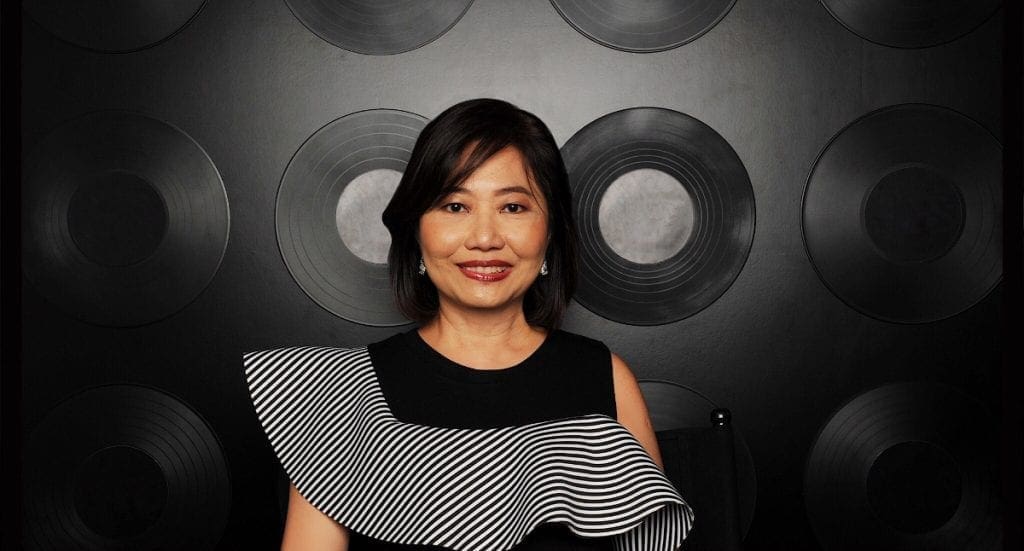

We had the chance to talk with Noel Lee, co-founder of AutoWealth, and he explained to us how it uses Robo Advisors along dedicated wealth managers to enable people to achieve their dreams sooner.

Q. Hi, Noel! Could you introduce yourself to our readers?

Hi everyone! I am Noel Lee, the co-founder of AutoWealth. I am a management consultant, turned into an amateur coder, and now turned co-founder of a fintech startup!

I believe that anything is possible as long as you put your heart and soul into it.

Q. Can you share with us the background story of AutoWealth?

It all started in a conversation during late 2015, with two scrappy, idealistic young men who got together to talk about how many mutual funds are making people poorer by not even beating the inflation rate!

We shared an interest in startups, and during that conversation, we devised a platform that could provide useful investment recommendations and full investment management services, at a quarter the fees of traditional financial services, all thanks to technology.

That day, AutoWealth was born, and now everyone can take home good net investment returns and achieve their dreams!

Q. Why did you decide to start-up?

My inspiration came from the story of Tan Kah Kee, a Chinese businessman who, back in the earliest days of Singapore, spent most of his fortune helping the less fortunate in his community. I, too, strived to start a successful business that could impact many lives in a meaningful and positive way.

Q. Care to share a bit about yourself and your team?

Our team is headed by Ow Tai Zhi, a seasoned fund manager and a commanding officer of the Singapore Reserve army. Supporting him are an ex-management consultant, a PhD in machine learning, a veteran in wealth management, an ex-private banker and a number of very youthful interns, who are always a joy to have!

Our army-trained CEO runs a very tight ship, and the team works tirelessly to help retail investors achieve their dreams.

Q. Could you explain to our readers how AutoWealth works?

AutoWealth uses cutting edge technology to automate 80 percent of the financial planning and advisory process. Instead of paying high fees to a human, financial planner, you only need to go through four simple steps to enjoy our services:

- Answer a concise questionnaire so we can know you better.

- Review the recommended investment advice, generated based on your inputs from Step 1.

- Book a 15-minute appointment to meet our representative, at a place and time of your choosing, to open an account.

- We manage your investments, while you enjoy good investment returns.

Right now, we are helping hundreds of users manage millions of dollars in assets and generating high net investment returns, which go a very long way in helping them achieve their dreams faster.

Q. Can you explain to our readers the diversification strategy of your Robo Advisor, and why are you using it?

You see, every investment portfolio recommended by AutoWealth consists of more than 8,000 equities and 800 government bonds across four major geographical regions (US, Europe, APAC and emerging markets) and all major industries (finance, technology, oil and gas etc.)

Such diversified investment portfolios are more defensive against market turmoil and recessions than an investment portfolio focused in a single asset class (e.g. stocks), geographical region or industry.

We chose this diversification strategy because we know that our clients are investing for essentials in life such as providing education for their children and retirement. We can’t expose this money to high risk.

Q. How do you manage to keep your fees lower than your competitors?

We run a very lean team and rely heavily on automation. When it comes to marketing, we take a very surgical approach, and we only go for the highest impact area of growth. Both of these allows us to pass all the cost savings back to our clients.

Q. How does the RoboAdvisor compare to classic, in-person financial advisors?

Logic is the only driver in our algorithm-based investment advice, making it unaffected by the mood of classic, human financial advisors, as well as skipping any bias towards pushing specific products. It recommends the most suitable investment portfolio based on user inputs, and it only takes 10 minutes to receive advice, instead of a few hours of small talk.

Q. How do we know when we need a Robo Advisor?

A: You know it’s time for a Robo Advisor when you feel tired of low investment returns and high fees, and find the “slightly reduced human touch” acceptable.

Despite this, the human touch is only slightly reduced because, while the whole advisory process is automated, all investors are still assigned dedicated wealth managers who are always one WhatsApp message away.

Q. Are you using artificial intelligence, deep learning, blockchain or any other “hot” technology?

We have plans to make use of all the above once the market becomes more accepting of Robo Advisors.

Q. What do you think it takes to become a successful entrepreneur?

It’s vital to go at it with a team. The path of an entrepreneur is full of obstacles, and no matter how competent or optimistic an entrepreneur is, he or she will be demoralised at some point and feel like giving up. This is where a teammate comes to you and says, “It’s ok, take a few days off to recharge, we will pick up where you left off.”

Such a team dynamic is essential in making the highly demanding life of an entrepreneur sustainable.

Q. Setting up a business is definitely not easy. Who do you get your inspiration and strength from?

At first, I was inspired by the story of Tan Kah Kee, and I now draw strength from my family, friends, my team and most importantly, our clients. Nothing beats knowing that, thanks to your business, many people are now closer to achieving their dreams.

Q. There are many aspiring entrepreneurs out there. Any advice you’d like to give them?

Never go at it on your own, it is not sustainable. Find a reliable team first.

Q. Where do you hope to take AutoWealth next?

I plan to work tirelessly to bring AutoWealth to more countries in the region very soon! We are experiencing tremendous traction, and have produced excellent investment returns for our clients. We hope that one day, we can have a presence all over Asia and help even more people achieve their dreams.

You can keep up with AutoWealth by following them on their Facebook page and website.

Responses